What are the main documents I need to make a funding application?

Establishing your mortgage application any seem like a daunting task as the list of documents requested is sometimes long. The documents are required for the approval of your mortgage application. They are used to analyze your personal and professional situation and your assets. They are also used to confirm the value of the property being financed. Here’s a brief summary of the documents you will need for your loan application.

When you apply for a mortgage loan, you must provide numerous documents to confirm your situation. Among them are:

- Documents related to your personal circumstances: identity documents, residence permit

- Documents related to your tax situation: details of your most recent tax return, tax receipts

- Documents providing evidence of your income and financial charges: income statements, payslips, leasing contracts, etc.

- Documents providing evidence of your own funds: deed of gift, property sale, savings account statement

- Documents relating to the real estate property to be mortgaged: sales brochure, plans, etc.

Why do I need to provide lenders with these documents?

All financial institutions offering mortgage services are regulated by the FINMA. All lenders are required to ensure that:

- borrowers are solvent

- the value of the property corresponds to the market.

They need to check that borrowers comply with the authorized debt-to-income and loan-to-value ratios. They, therefore, need access to certain documents to confirm this.

When and how should I prepare these documents?

Most lenders wait until they have all your documents before examining your application. However, waiting to put them all together before starting your funding application could compromise your planned purchase. The time period between identifying the property of your dreams and going before the notary to finalize the transaction is often short.

You only have one chance to make the right first impression with a lender. To give yourself the best chance, we recommend that you always submit a loan application accompanied with the key elements for an initial analysis. Some documents will only be necessary later on (to obtain your loan contract or even when the keys are handed over).

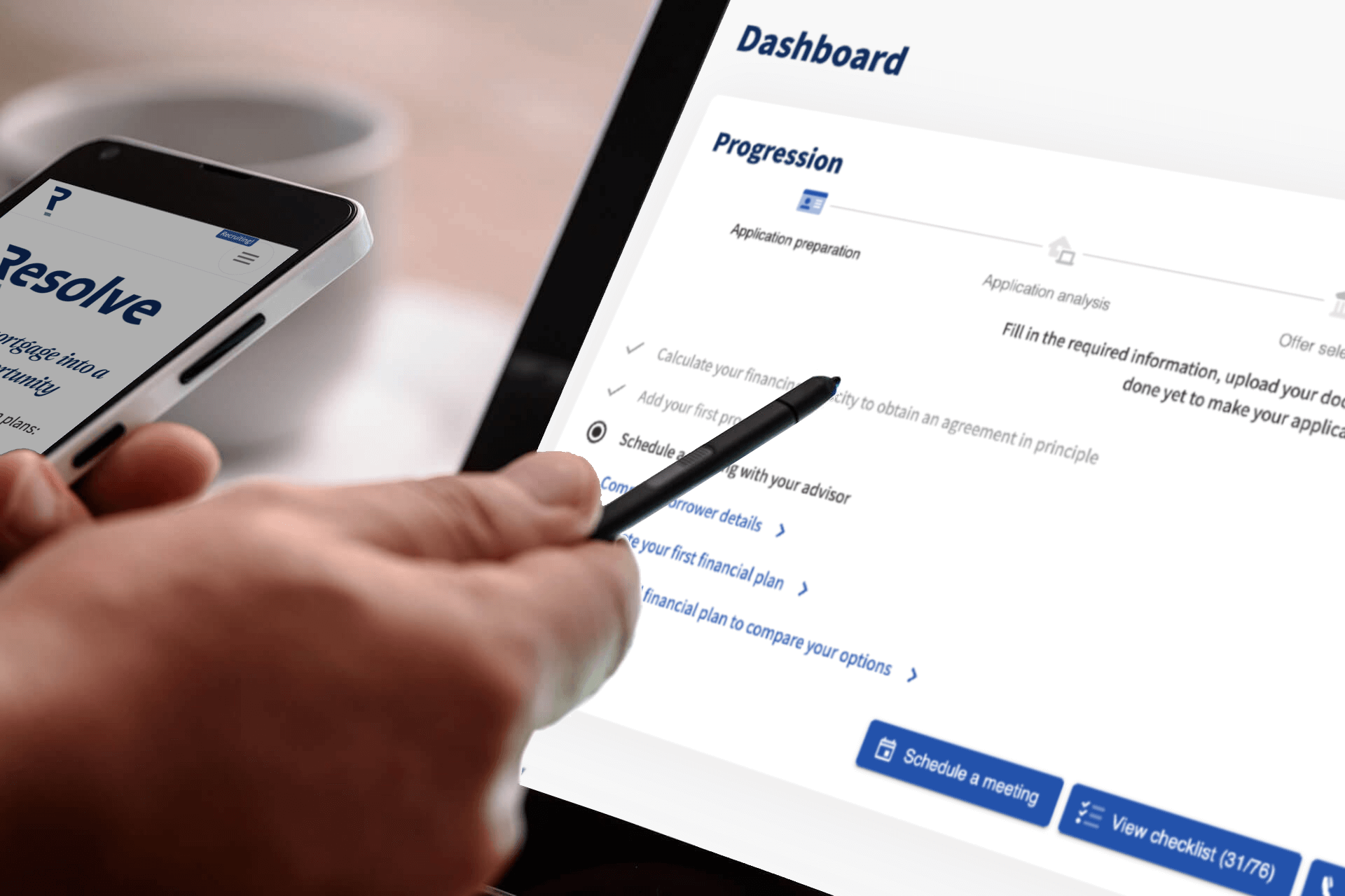

When you enter your details on your Resolve space, the list of documents requested will be automatically updated. You can then upload them securely. We can transmit an application of irreproachable quality to a lender.

It is important to know that all institutions monitored by FINMA, including Resolve, must keep all client data confidential. Once the analysis is complete, the documents are archived (in Switzerland) or destroyed. Resolve regularly carries out intrusion tests on its information systems to ensure that its security is optimal.

Documents related to borrowers

Documents that prove your identity

Before examining the financial aspect of your application, financial institutions want to know how you are established in Switzerland. One or more identity documents will, therefore, be requested. They may include a copy of your passport, ID card, legitimation card, or your work permit depending on your nationality. These documents will also be used on opening relations with your chosen lender.

You may also need to provide a copy of your livret de famille or divorce settlement. In short, any documents that can prove your family circumstances.

Finally, lenders also request an extract from the Execution Office for each borrower.

Documents that provide evidence of your professional circumstances

Financial institutions request these documents to confirm your salary level and the stability of your situation. Their aim is to ensure that the risk taken in granting a loan is low and controlled.

The documents requested will depend on your business sector. If you are an employee, documents such as payslips, and your most recent annual salary certificate will, therefore, be required. An employment contract will also be requested. This will be used to confirm elements such as the duration of a trial period or the remuneration that will be received.

If you are independent or hold shares in the company you work for, you will need to provide your most recent accounts and an extract from the trade register.

Documents that prove your financial situation

Clients must provide evidence of their current savings to confirm that own funds are available for the purchase. Up-to-date statements of financial condition will suffice.

Financial institutions are also required to ensure the own funds of their clients comply with taxation rules. Indeed, being affiliated to the FINMA, these institutions fight money laundering and tax evasion. Undeclared assets cannot be considered as own funds. The client’s latest income tax return will confirm this point.

If your contribution is partially made up of pension assets (second and/or third pillar), the institutions must ensure that the amount you wish to benefit from is available and useable for the property purchase in question. An up-to-date certificate of second pillar pension assets and a third pillar account statement will, therefore, be necessary.

In the case of the withdrawal of your second pillar, lenders will require a certificate of assets to give them a long term perspective on your pension situation.

Finally, each institution also makes sure that any small credits are taken into account in the analysis. In the case of leasing or consumer credit, actual charges will be used. Each institution can use the information center (ZEK) to ensure that even small loans are that may have been forgotten in tax declarations do not escape their notice.

Documents related to the real estate property

With the most recent economic crises, banks and insurance companies have become more cautious in terms of the level of risk they are ready to take regarding mortgage loans. This is why a contribution from the client is demanded for every real estate transaction. Lending institutions start from the principle that by granting a loan of at most 80% of the value of the property, it will be easier for them to recover their commitment in the event of the debtor defaulting, for example. Of course, depending on the type of property, the loan-to-value ratio varies and the risk taken by the bank is not the same.

The documentation requested is used to classify the object of the purchase, estimate its value, and determine the risk that the financial institution is prepared to take on your property purchase.

Lenders will first seek to learn about your proposed real estate purchase as a whole. What do you want to buy? In which commune? At what price? All of this basic information will appear on the sales brochure that was provided to you by the broker in charge of the sale or directly by the seller.

The plans also form part of the key documents in this analysis. They are used to confirm the number of rooms and bathrooms and the surface area of the property.

When you buy a property that is located within a commonhold, there is another document, the register of division of ownership (or cahier de répartition). This is a booklet that specifies all the lots that the building contains. The official living space is mentioned and the share of the building held by each lot. It allows the buyer to check that the commonhold charges are fair.

In Switzerland, all constructions must be insured by an insurance company. This covers so-called “natural” damage amongst other things. This building insurance is essential for financial institutions. It allows lenders to ensure that, in the event of damage, the costs of rebuilding will be covered by the insurer.

If you are considering a new build, additional documents will be required. The building description specifies the materials that will be used during the building work, the finishes proposed by the promoter, etc.

All the documents mentioned above help the lender value the property. The creditors use their tools to ensure that the purchase price corresponds to current market prices and, consequently, that the future mortgage exposure will not be too high.

Documents provided by the notary

Every real estate transaction must be signed before a notary. The latter will draft a deed of purchase so that the transaction is validated and recorded. Information such as the names of the parties (buyers/sellers), the property concerned by the transaction, its price, and the date on which the transfer of ownership will take place appears on the deed.

This document will be signed by both parties on the day of signing before the notary. Before the signature date, each party will be provided with a “draft” deed of purchase. This allows both parties to read the document and make any modifications.

Credit institutions require this document to ensure that information such as the final transaction price and the property concerned are correct and that the lending institution is financing the right property purchase.

The notary will also act as an intermediary between the buyer(s) and the seller(s). The funds used for the purchase will be sent to the notary, who will then transfer them to the seller(s) after deducting and residual credit.

Financial institutions require an additional mortgage guarantee. This is known as a mortgage note. The note is a paper security (in paper or electronic format depending on the canton), which guarantees the loan awarded. The amount of the note must be at least equal to the amount borrowed. As the lender cannot put the real estate property in a safe, this note serves as a loan guarantee. The notary prepares the constitutional deed for the mortgage note.

Finally, each property owner is registered and listed on a canton-wide database known as the Land Registry. The Land Registry brings together information on housing, rights, charges, pledging, etc. A lot of information is recorded on the Land Registry including the credit institution, the withdrawal of second pillar pension assets, any limitations related to the property, etc. This document can only be consulted by banks, notaries, or on request.

The documents required for a complete dossier vary according to your circumstances and your project. The list can grow quickly and its complexity will depend on your profile.

Resolve provides you with a secure online space where you can store the exact list of the documents you will need. Indeed, according to the information you give us, the list is updated to ensure that your application has the best chance of success with all lenders.

Your advisor will then take care of sending it to the best institutions for analysis.

Start your project online or contact our teams to move forward.

%20(1).jpg?ixlib=gatsbyFP&fit=max&auto=compress%2Cformat&q=50&w=8192)