Luxury real estate and HNW clients*: our Premium department is expanding

We are developing our Premium service to support HNW* clients in their search for asset financing. Yannis Eggert, co-founder of Resolve, is leading this project.

This "family office for financing" created within Resolve is dedicated to supporting clients whose wealth sometimes exceeds one billion, but it also offers tailor-made advice for clients with more modest assets who do not always fit into the usual credit policy boxes.

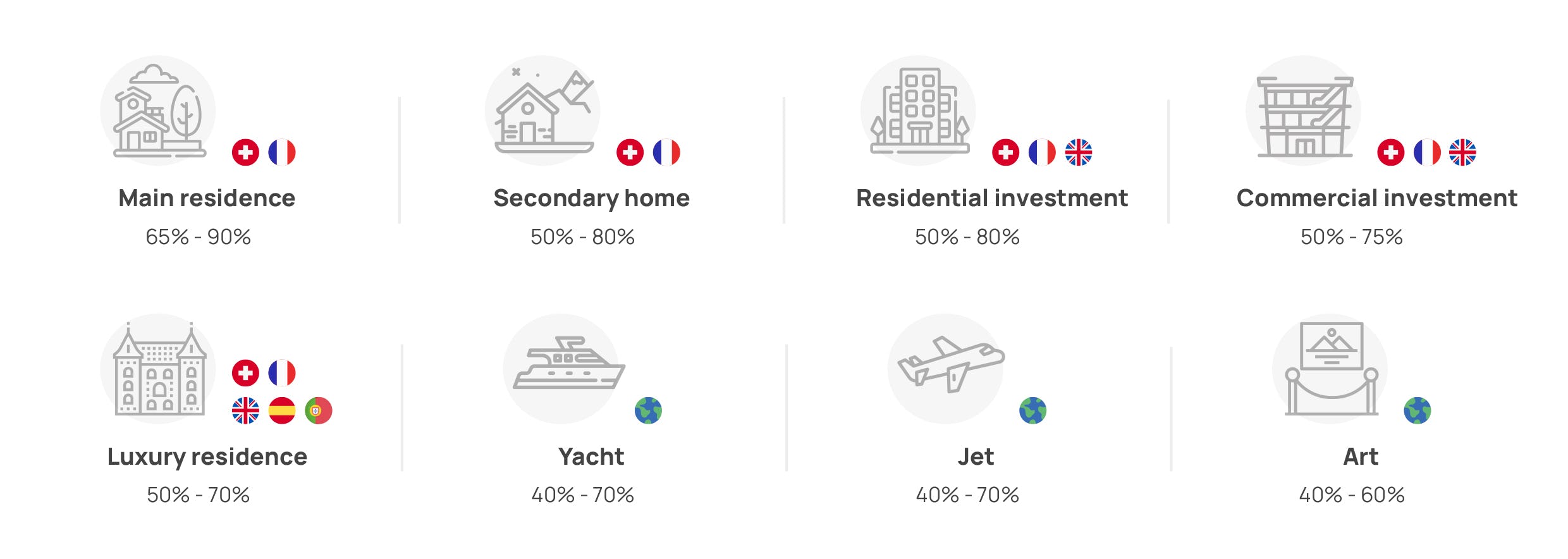

Since its launch in 2018, Resolve has been accompanying and providing personalized advice to this clientele with atypical needs. This concerns, for example, people whose income is essentially made up of variable income or returns; objects to be financed abroad, or when the amounts of financing sought exceed CHF 50 million. The financing needs of these individuals are multiple and can cover the acquisition of personal assets (primary or secondary residences, yachts, jets, works of art), or real estate investments (development, promotions, investment properties).

Objects and countries for which Resolve negotiates financing terms with possible financing ranges.

One might think that this type of client would be able to access alternatives to traditional financing because of their significant assets. However, they are most often looking for customized financing solutions based on these assets.

Deploying a customized financing service in Switzerland and abroad

Finding solutions for (U)HNWI* customers requires excellent market knowledge. The structuring of this premium business is in response to a growing demand from our customers.

Each Resolve branch in Switzerland already has a Premium department. We are planning to set up representative offices in Monaco, Dubai and London in the near future.

Putting technology to work for premium customers

Our interface centralizes the credit conditions of the lenders active in this customer segment, which allows us to produce instant financing proposals. The interface centralizes the project data in a secure manner and then allows the client (or his representative: family office, independent asset manager, private banker) to follow the progress of his request in real time, managed by his Premium Resolve advisor.

The centralization of data in the interface relieves our clients of a certain administrative burden and ensures the completeness of the loan applications we present to lenders on their behalf.

* (Ultra) High Net Worth Individuals