The Swiss residential real estate market after Covid-19

Many experts expect an economic recession in 2020. They believe that the extent of this crisis will mostly depend on how long global lockdown measures last, with a few exceptions. As Switzerland will not escape this negative economic environment, the question of the existence of risks related to a potential housing crisis must be asked.

The residential housing market remains stable overall.

A recent study by Wüest & Partner shows that despite “an expected temporary drop in market value, most financed housing properties will exceed the value of bank collateral. We should only expect defaults on credit and forced sales if the crisis lasts for several years. Yet, no one is currently predicting this.” The likelihood of a housing market crash, therefore, remains negligible, which will reassure both current owners and prospective buyers.

Despite a small rise in mortgage interest rates observed at the end of March 2020, rates remain at historically low levels. Since April, the “interbank” IRS base rate has stabilized at around -0.28%, confirming their attraction for any prospective buyer. Remember that following pessimistic growth forecasts, banks and insurance companies had anticipated a future shortfall in liquid assets resulting in a temporary rise in mortgage interest rates. You will find a detailed analysis of this sudden rise in our previous article.

A market environment dominated by negative interbank interest rates creates favorable conditions for anyone who wants to purchase real estate. All the costs associated with real estate acquisition including mortgage interest, amortization, and maintenance costs usually end up being lower than those associated with a rental, without taking into account a property’s potential to increase in value over the years.

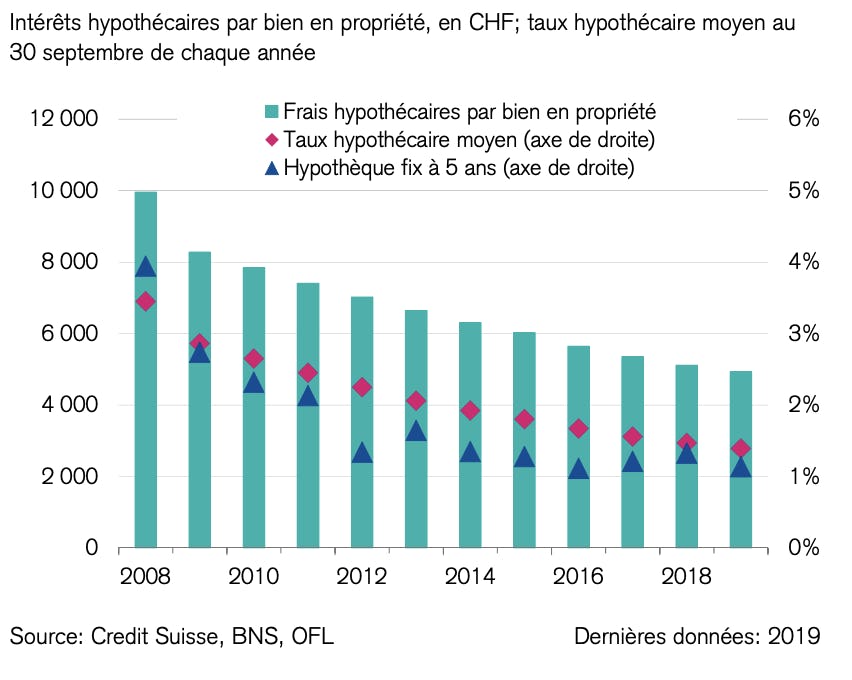

Figure 1 : Mortgage costs for existing owners

The above figure clearly shows a trend of decreasing mortgage costs for Swiss households. This drop, combined with toughening of the conditions for granting credit, represents a sustainable financial burden for Swiss households, which are not suffering from a temporary shortfall. Today, they are also at less risk from a temporary drop in revenue resulting from the Covid-19 health crisis than they were before.

Even though the national unemployment rate reached 2.9% in March, according to the Secretary of State for the Economy, these statistics remain well below the average rate in Europe. The flexibility offered by the partial unemployment (furlough) scheme should also absorb lay-offs resulting from the crisis to a large extent, maintaining a certain income threshold.

To this, we can add the many aid measures announced by the Swiss government for both individuals and businesses, which should mitigate the risk of default on the Swiss mortgage market.

Fears of a housing crash seem, to us, unjustified as the residential market vectors have not been unduly affected and are not at risk of immediate deterioration.

Real estate financing

Used by the FINMA to regulate the mortgage market, the conditions for granting credit or “financing” are inseparable from the real estate market. The most recent example of this was the removal of the banks’ countercyclical capital buffers. This measure gave banks more freedom to grant credit and was aimed at alleviating the economic consequences of the coronavirus pandemic.

Despite the resilience of the real estate market discussed in this article, we should remember that any investment involves risk. Whether it is for a primary residence, rental investment, or mortgage renewal, poorly structured real estate financing exposes the purchaser to several risks.

Take the surprisingly under-reported case of households that took out a mortgage loan more than ten or so years ago. At the time, some financial institutions were a little less careful concerning the ability of households to bear mortgage costs on retirement. And when the mortgage loan expired, some households were refused the renewal of their loan due to their current lack of income.

The theoretical charge of 5% of the interest rate that corresponds, within a few decimals, to the average interest rate of the last five years, is often problematic. Indeed, financial institutions require owners to have a level of income three times higher than the theoretical costs of home ownership. There are, however, a few solutions for households that do not fulfill these conditions today.

Now, despite optimistic forecasts about the Swiss real estate market, some households may find themselves at risk without a downturn in the Swiss economy. In light of this, it is advisable to contact a mortgage finance broker for any real estate project. They will find the best financing structures according to the client’s situation and support them in strategic decision-making.

The information contained on this website is for information purposes only. This information can in no way be construed as a recommendation, invitation, or offer to conclude a contract, nor to purchase or sell real estate.